By Stefaan Ghijs

Food and beverage industry

The food and beverage industry is nowadays dominated by very strong industrial parties and globally operating retailers. The drive for growth and profit in the fiercely competitive world food market is leading to further consolidation and expansion in every part of the food and beverage sector. A logical consequence is that more and more large-scale companies increase and smaller players are disappearing. The total global food & beverage market accounts for more than four trillion USD in sales! In order to participate internationally at a high level, more and more food and beverage brands will invest in scale.

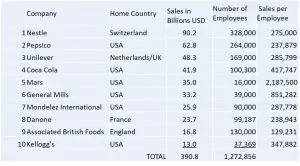

Only ten brands, six from the United States and four from Europe, control most of the food chain. The companies Kraft, Coca-Cola, Nestle, P & G, Johnson & Johnson, Unilever, PepsiCo, General Mills, Kellogg’s and Mars are involved in almost all major brands of food and beverages that you see on the shelves of the supermarket.

As a result, many national food & beverage companies are disappearing from the scene, merging or merging into large-scale international, managed companies. They are forced to take this step because they have to produce more efficiently and at lower costs.

In addition to more international trade, international competition is also increasing. This makes scale and innovation important drivers.

Mergers and acquisitions

The food industry is interesting for investors. As a result, the number of takeover deals in the food industry is expected to continue to increase in the coming years. These acquisitions are stimulated because large food companies have a lot of capital available. The most important buyers are American, English, French and German food producers.

Approximately 18% of international acquisitions were made this year from the United States. In most of these transactions, the takeover candidate was European. This interest is also partly the result of the favorable economic expectations in Europe. However, there are many political developments such as Brexit that can have repercussions on the (European) economy and the takeover market.

Air taxis and private jets

Characteristic of the food production industry is that the production of food products takes place throughout Europe. It is therefore often difficult to carry out several meetings for mergers or acquisitions in a short period of time.

American groups planning a takeover want to spend their time as short as possible on European soil. The practical use of airplanes is so common in the American society that they often use air taxis or private jets in Europe. Their goal: to minimize the loss of travel time and to make the working days more productive.

How can Fly Aeolus help the food industry?

Fly Aeolus is a European air taxi company. In recent years we have already helped many food and beverage companies with the transport to and from takeover deals in Europe. With a fleet of 13 single-engine aircraft scattered throughout Europe, we always have an air taxi available. Our air taxi’s can take you quickly and safely to your destination at an affordable price and without unnecessary waiting times.

Do you want to calculate the savings of productive time yourself? Then view our air taxi price calculator on our website.

If you have any questions or would like to receive further information, you can either send us an e-mail at info@flyaeolus.com or call us at +32 (0)3 500 9082.